-

college costs

Obama takes on college costs, eyes young voters

By BEN FELLER | Associated Press – 4 hrs ago

WASHINGTON (AP) — Wooing young voters, President Barack Obama is on a blitz to keep the cost of college loans from soaring for millions of students, taking his message to three states strategically important to his re-election bid. By taking on student debt, Obama is speaking to middle-class America and targeting an enormous burden that threatens the economic recovery.

Before Obama got his road trip under way, Republican opponent Mitt Romney found a way to steal some thunder from the president's campaign argument: He agreed with it.

The competitors are now on record for freezing the current interest rates on a popular federal loan for poorer and middle-class students. The issue is looming because the rate will double from 3.4 percent to 6.8 percent on July 1 without intervention by Congress, an expiration date chosen in 2007 when a Democratic Congress voted to chop the rate in half.

Obama is heading to campuses in the South, West and Midwest to sell his message to colleges audiences bound to support it. As he pressures Republicans in Congress to act, he will also be trying to energize the young people essential to his campaign — those who voted for him last time and the many more who have turned voting age since then.

The president speaks Tuesday at the University of North Carolina at Chapel Hill and the University of Colorado at Boulder, and then the University of Iowa on Wednesday. All three universities are in states that Obama carried in 2008, and all three states are considered among the several that could swing to Obama or Romney and help decide a close 2012 election.

Both campaigns are fighting for the support of voters buried in college debt. The national debt amassed on student loans is higher than that for credit cards or auto loans.

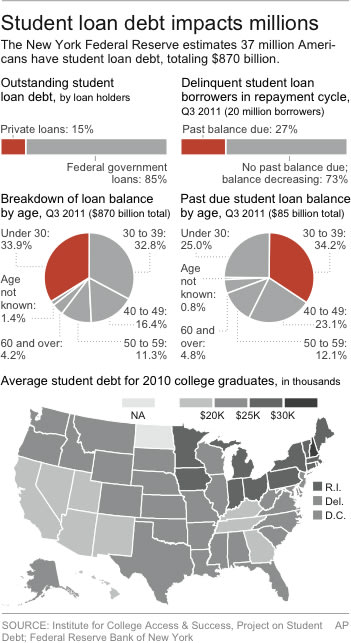

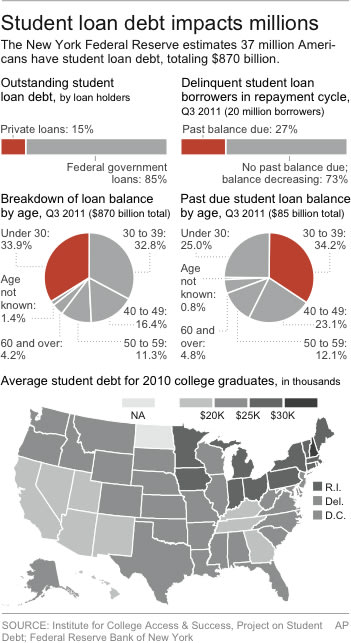

The Federal Reserve Bank of New York has estimated about 15 percent of Americans, or 37 million people, have outstanding student loan debt. The banks put the total at $870 billion, though other estimates have reached $1 trillion. About two-thirds of student loan debt is held by people under 30.

Obama, previewing the message he will give at all three colleges, said over the weekend that allowing the interest rates to double this summer would hurt more than 7 million students. The White House said it would cost students $1,000, based on the average amount borrowed a year ($4,200) and the average time it takes to pay the loan (12 years).

"That would be a tremendous blow," Obama said. "And it's completely preventable."

Romney agreed with that conclusion even in the midst of blasting Obama's economic leadership. "Given the bleak job prospects that young Americans coming out of college face today, I encourage Congress to temporarily extend the low rate," Romney said in a statement.

Obama and Romney are championing what amounts to a one-year, election-year fix at a cost of roughly $6 billion. Congress seems headed that way. Members of both parties are assessing ways to cover the costs and win the votes in the House and Senate, which is far from a political certainty. All parties involved have political incentive to keep the rates as they are.

Obama carried voters between the ages of 18-29 by a margin of about 2-to-1 in 2008, but many recent college graduates have faced high levels of unemployment. That raises concerns for the president about whether they will vote and volunteer for him in such large numbers again.

http://news.yahoo.com/obama-takes-co...071825286.html

comments

The most effective way to reduce college costs would be to stop creating excess and unneeded demand by government subsidies. Any increase in government assistance will increase costs. It always has and it always will.

..

Instead of trying to buy the votes of college students, 0bama should do his part to fix the economy. He can start by lowering gas prices with an export duty. Set high enough, that keeps domestically produced gasoline in the US for the use of American consumers.

Low gas prices = more jobs.

Student loans are like running on a treadmill. As student loan amounts increase, colleges increase tuition to match the larger loan amount.

..

Half of the college grads today either cannot find a job or are underemployed, so yeah let's make sure we subsidize students who want to major in basket weaving on the taxpayers' dime.

..

This clown is going to promise the world to these college students to get their vote. Hell student loans are already a trillion dollars in default. And who is going to pay them? The clown has no record to go on, so he's has to get votes somewhere! So he goes to the mis informed. Most not all go to college just to party, I know I drive truck and go up Franklin St. every morning about 1 AM . And the clown is going to the right town, Chapel Hill, nothing but liberal live there. Who want everything for free and want the tax payers to foot the bill.

..

Yet, it's his friends and supporters in Academia that are getting fat off the tuition rates. Who runs the colleges? Conservatives? Ha! Guess again.

..

Just another effort to divide and conquer America. Obama and his cronies are creating more smoke and mirrors instead of actually tackling the problems in the country. Knowledge is a great asset in life but what good is it if you complete school only to live at your parents' house and look for work that will put you in the underemployed category.

Laissez les bon temps rouler!  Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

-

-

04-24-2012 04:47 AM

# ADS

Circuit advertisement

-

1in 2 new graduates are jobless or underemployed

By HOPE YEN | Associated Press – 17 hours ago

WASHINGTON (AP) — The college class of 2012 is in for a rude welcome to the world of work.

A weak labor market already has left half of young college graduates either jobless or underemployed in positions that don't fully use their skills and knowledge.

Young adults with bachelor's degrees are increasingly scraping by in lower-wage jobs — waiter or waitress, bartender, retail clerk or receptionist, for example — and that's confounding their hopes a degree would pay off despite higher tuition and mounting student loans.

An analysis of government data conducted for The Associated Press lays bare the highly uneven prospects for holders of bachelor's degrees.

Opportunities for college graduates vary widely.

While there's strong demand in science, education and health fields, arts and humanities flounder. Median wages for those with bachelor's degrees are down from 2000, hit by technological changes that are eliminating midlevel jobs such as bank tellers. Most future job openings are projected to be in lower-skilled positions such as home health aides, who can provide personalized attention as the U.S. population ages.

Taking underemployment into consideration, the job prospects for bachelor's degree holders fell last year to the lowest level in more than a decade.

"I don't even know what I'm looking for," says Michael Bledsoe, who described months of fruitless job searches as he served customers at a Seattle coffeehouse. The 23-year-old graduated in 2010 with a creative writing degree.

Initially hopeful that his college education would create opportunities, Bledsoe languished for three months before finally taking a job as a barista, a position he has held for the last two years. In the beginning he sent three or four resumes day. But, Bledsoe said, employers questioned his lack of experience or the practical worth of his major. Now he sends a resume once every two weeks or so.

Bledsoe, currently making just above minimum wage, says he got financial help from his parents to help pay off student loans. He is now mulling whether to go to graduate school, seeing few other options to advance his career. "There is not much out there, it seems," he said.

His situation highlights a widening but little-discussed labor problem. Perhaps more than ever, the choices that young adults make earlier in life — level of schooling, academic field and training, where to attend college, how to pay for it — are having long-lasting financial impact.

"You can make more money on average if you go to college, but it's not true for everybody," says Harvard economist Richard Freeman, noting the growing risk of a debt bubble with total U.S. student loan debt surpassing $1 trillion. "If you're not sure what you're going to be doing, it probably bodes well to take some job, if you can get one, and get a sense first of what you want from college."

Andrew Sum, director of the Center for Labor Market Studies at Northeastern University who analyzed the numbers, said many people with a bachelor's degree face a double whammy of rising tuition and poor job outcomes. "Simply put, we're failing kids coming out of college," he said, emphasizing that when it comes to jobs, a college major can make all the difference. "We're going to need a lot better job growth and connections to the labor market, otherwise college debt will grow."

By region, the Mountain West was most likely to have young college graduates jobless or underemployed — roughly 3 in 5. It was followed by the more rural southeastern U.S., including Alabama, Kentucky, Mississippi and Tennessee. The Pacific region, including Alaska, California, Hawaii, Oregon and Washington, also was high on the list.

On the other end of the scale, the southern U.S., anchored by Texas, was most likely to have young college graduates in higher-skill jobs.

The figures are based on an analysis of 2011 Current Population Survey data by Northeastern University researchers and supplemented with material from Paul Harrington, an economist at Drexel University, and the Economic Policy Institute, a Washington think tank. They rely on Labor Department assessments of the level of education required to do the job in 900-plus U.S. occupations, which were used to calculate the shares of young adults with bachelor's degrees who were "underemployed."

About 1.5 million, or 53.6 percent, of bachelor's degree-holders under the age of 25 last year were jobless or underemployed, the highest share in at least 11 years. In 2000, the share was at a low of 41 percent, before the dot-com bust erased job gains for college graduates in the telecommunications and IT fields.

Out of the 1.5 million who languished in the job market, about half were underemployed, an increase from the previous year.

Broken down by occupation, young college graduates were heavily represented in jobs that require a high school diploma or less.

In the last year, they were more likely to be employed as waiters, waitresses, bartenders and food-service helpers than as engineers, physicists, chemists and mathematicians combined (100,000 versus 90,000). There were more working in office-related jobs such as receptionist or payroll clerk than in all computer professional jobs (163,000 versus 100,000). More also were employed as cashiers, retail clerks and customer representatives than engineers (125,000 versus 80,000).

According to government projections released last month, only three of the 30 occupations with the largest projected number of job openings by 2020 will require a bachelor's degree or higher to fill the position — teachers, college professors and accountants. Most job openings are in professions such as retail sales, fast food and truck driving, jobs which aren't easily replaced by computers.

College graduates who majored in zoology, anthropology, philosophy, art history and humanities were among the least likely to find jobs appropriate to their education level; those with nursing, teaching, accounting or computer science degrees were among the most likely.

In Nevada, where unemployment is the highest in the nation, Class of 2012 college seniors recently expressed feelings ranging from anxiety and fear to cautious optimism about what lies ahead.

With the state's economy languishing in an extended housing bust, a lot of young graduates have shown up at job placement centers in tears. Many have been squeezed out of jobs by more experienced workers, job counselors said, and are now having to explain to prospective employers the time gaps in their resumes.

"It's kind of scary," said Cameron Bawden, 22, who is graduating from the University of Nevada-Las Vegas in December with a business degree. His family has warned him for years about the job market, so he has been building his resume by working part time on the Las Vegas Strip as a food runner and doing a marketing internship with a local airline.

Bawden said his friends who have graduated are either unemployed or working along the Vegas Strip in service jobs that don't require degrees. "There are so few jobs and it's a small city," he said. "It's all about who you know."

Any job gains are going mostly to workers at the top and bottom of the wage scale, at the expense of middle-income jobs commonly held by bachelor's degree holders. By some studies, up to 95 percent of positions lost during the economic recovery occurred in middle-income occupations such as bank tellers, the type of job not expected to return in a more high-tech age.

David Neumark, an economist at the University of California-Irvine, said a bachelor's degree can have benefits that aren't fully reflected in the government's labor data. He said even for lower-skilled jobs such as waitress or cashier, employers tend to value bachelor's degree-holders more highly than high-school graduates, paying them more for the same work and offering promotions.

In addition, U.S. workers increasingly may need to consider their position in a global economy, where they must compete with educated foreign-born residents for jobs. Longer-term government projections also may fail to consider "degree inflation," a growing ubiquity of bachelor's degrees that could make them more commonplace in lower-wage jobs but inadequate for higher-wage ones.

That future may be now for Kelman Edwards Jr., 24, of Murfreesboro, Tenn., who is waiting to see the returns on his college education.

After earning a biology degree last May, the only job he could find was as a construction worker for five months before he quit to focus on finding a job in his academic field. He applied for positions in laboratories but was told they were looking for people with specialized certifications.

"I thought that me having a biology degree was a gold ticket for me getting into places, but every other job wants you to have previous history in the field," he said. Edwards, who has about $5,500 in student debt, recently met with a career counselor at Middle Tennessee State University. The counselor's main advice: Pursue further education. "Everyone is always telling you, 'Go to college,'" Edwards said. "But when you graduate, it's kind of an empty cliff."

http://finance.yahoo.com/news/1-2-gr...140300522.html

Laissez les bon temps rouler!  Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

-

-

comments

Don't feel special class of 2012, ya'll are just joining the classes of 2008, 2009, 2010, and 2011. I graduated in 2009 and just found a job 9 months ago. I had to move a thousand miles from home to find one, but at least I have one.

..

the yahoo article just a few weeks ago said the 2012 graduates are finding jobs plentiful. so which is it?

..

In the 1940s less than 10% of people had a college degree...so it was worth something. Over the last 25 years we have churned out millions and millions and millions of graduates. Its like any other product...flood the market and the value decreases.

..

Not every college graduate has skills. It's important to recognize one's capabilities and true calling before spending tens and hundreds of thousands of dollars on wasted education.

..

Welcome to the new American Normal. While you were engrossed in Social Networking and embracing the Information Based Economy, China and India took over lucrative manufacturing and bested you in the study of science and math. The only thing the USA produces is debt that it can ill afford. Student debt has eclipised credit card debt.

..

Opportunity is missed by most people because it is dressed in overalls and looks like work.

Thomas A. Edison

..

I have a friend who spent close to $80,000.00 to send her youngest daughter to a private 4-year college in West Los Angeles. She borrowed some of the money against her paid off home. Which is never a good idea. The daughter was a business major. She graduated last June 2011. She is now working part-time in a dress shop in Santa Monica, and does babysitting on the side. And so it goes.....

..

I have a couple of useless liberal arts degrees(BA in Journalism, MA in English). I really believe that every college student should be required to take a course titled "What I am Going to do With This Degree When I Graduate." If I had taken that class I would have majored in math.

..

We tried to warn you that the dealer always wins at Three Card Monte, but you wouldn't listen.

Laissez les bon temps rouler!  Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

-

-

$80K for 4 years at a private university! What a deal! It cost that much for 1 year at my oldest sons university. Now he is in grad school. When he finishes he will be have student loan debt of about $250K. I am confident he will find gainful employment. But it is still ridiculous what colleges charge. On top of crazy professor salaries, they then use TAs (teacher assistant, usually grad students) to do their job. My youngest son is tired of having the actual professor re-grade his tests because the TA is wrong.

Me

-

-

House to vote Friday on student loans

By ALAN FRAM | Associated Press – 39 mins ago

WASHINGTON (AP) — Speaker John Boehner says the House will vote Friday on a Republican bill preventing interest rates on federal student loans from doubling this summer. But the legislation will be paid for by cutting money from President Barack Obama's health care overhaul law.

With both parties competing for election-year support from students, Obama has been pressuring Congress to pass legislation keeping the current 3.4 percent interest rates on subsidized Stafford loans from doubling on July 1. Senate Democrats have introduced a bill that would do so, and would cover the $5.9 billion price tag by raising payroll taxes on the upscale owners of some privately owned corporations.

Boehner is trying to turn the tables on Democrats by scheduling Friday's vote, but paying for the measure in a way Republicans prefer.

http://news.yahoo.com/speaker-house-...--finance.html

http://l.yimg.com/bt/api/res/1.2/9.B...706700e461.jpg

the real truth is, 5 yrs ago when the dems were majority in both houses, they voted to double the student loan interest rates which is going into effect...

...

Dems see this as an opportunity..another "it ain't fair" rant..here comes the liberal posse with bags of money to throw at the complainers..gee students..try working while in school..it does not hurt

..

Americans educational system is 16th in the world and dropping and we spend the second highest per pupil: translation..it ain't working

Laissez les bon temps rouler!  Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

-

-

Thursday, April 26, 2012

How tough it must have been for the Obamas to pay off their student loans?

Hmmm. ABC News looks at Obama tax returns in the context of of his claim that the Obamas just paid off their student loans eight years ago and notes that they were earning enough to qualify for higher taxes under Obama's tax plan in some of those years when they still owed money on those loans. http://abcnews.go.com/blogs/politics...udent-loans-2/

But according to their tax returns, which are available on the White House website, the Obamas had a healthy, six-figure income by the year 2000 (the earliest return available). And for at least two years before his loans were paid off, Obama, by his own definition, made so much they were wealthy enough to pay higher taxes.

Here’s a rundown of the president’s income, according to his tax returns, in the years before he paid off his student loans:

2004: $207,647

2003: $238,327

2002: $259,394

2001: $272,759

2000: $240,505

In 2001 and 2002, the Obamas would have met the $250,000 standard the president has set for those wealthy enough to afford to pay more taxes.

Of course, earning over $200,000 a year doesn't mean that a family doesn't have expenses to pay. Remember this comment from 2008 when Michelle Obama was talking to struggling Ohio workers about the tough time the Obamas have making ends meet. http://www.nationalreview.com/articl...gle/byron-york

“I know we’re spending — I added it up for the first time — we spend between the two kids, on extracurriculars outside the classroom, we’re spending about $10,000 a year on piano and dance and sports supplements and so on and so forth,” Mrs. Obama tells the women. “And summer programs. That’s the other huge cost. Barack is saying, ‘Whyyyyyy are we spending that?’ And I’m saying, ‘Do you know what summer camp costs?’”

So you can see why it was so very hard for them to pay off those college loans. And for sure the federal government should be subsidizing interest rates for college grads who have these overhanging loans to pay back while they're struggling to make ends meet while providing their children with extracurriculars and summer camp. What type of selfish citizens would we be if we didn't help those future grads out with their interest payments so they could get by like the Obamas did?

http://betsyspage.blogspot.com/2012/...or-obamas.html

Laissez les bon temps rouler!  Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

-

-

Laissez les bon temps rouler!  Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

-

-

Who's to blame for the rising cost of student loans?

By The Week's Editorial Staff | The Week – 13 hrs ago

As Congress deadlocks over proposals to prevent interest rates from spiking, a look at five possible culprits in America's student-loan mess

This week, Senate Republicans blocked a measure that would prevent interest rates on government-subsidized student loans from doubling in two months — a move that comes at a time of already-intense anxiety over soaring college costs, which show no signs of stabilizing. Outstanding student debt in America recently reached the $1 trillion mark, surpassing the county's credit card and auto loan debt, and economists say it's becoming a burden on the broader economy. Who's to blame for this mess?

1. Republicans : The GOP says it has no desire to see interest rates on subsidized loans go up, but blocked the bill anyway, apparently to appease conservatives "who are hungry for confrontation with Democrats," says Sahil Kapur at Talking Points Memo. The Senate bill would have been paid for by closing loopholes that allow wealthy taxpayers to avoid Social Security and Medicare taxes, but Republicans, hemmed in by conservative anti-tax groups, say the measure will hurt job creators.

2. Democrats : Liberals claim that they want to prevent an interest-rate hike, but they're guilty of "political posturing" as well, says Marilou Johanek at The Toledo Blade. After all, Republicans in the House approved a bill that would pay for the subsidies with money taken from an ObamaCare preventive health care fund, but the vast majority of Democrats balked.

3. Too much government : Forget interest rates — the real problem is the way the government is involved in the student loan industry in the first place, says Robert Applebaum at The Hill. By guaranteeing loans against default, the government is making "free money" available "to anyone with a pulse who wants to take out a student loan." Colleges and universities "have had no incentive to keep costs down — and they haven't."

4. Too little government : One of the main reasons tuition costs have risen is because cash-strapped state legislatures "are cutting funding for state schools," says Ben Adler at The Nation. And at the federal level, the government could do a much better job of creating incentives for universities to improve affordability and the long-term value of the degrees they offer.

5. Students : Students don't make good "enrollment and borrowing decisions," say Mark Kantrowitz and Mark Schneider at TIME. They're "taking on too much debt" without factoring in whether a more expensive degree will actually help them find a better job in the future. "Financial literacy needs to be taught in secondary schools and colleges specifically to help students make sound education investment decisions."

http://news.yahoo.com/whos-blame-ris...134900452.html

comments

A better question is, "who is to blame for sky high tuitions?"

..

Schools are responsible. As Alex below said, the House passed a bill with EIGHT Democrats voting in the majority to keep them the same for one more year. Senate leader Reid REFUSES to allow that bill a vote in the Senate. The Senate is where BIPARTISAN PASSED House legislation dies!

..

I see the left wingers at the Week left out the fact that the House passed a bill to keep interest rates low using money from Obamacare that Obama said was not needed. The simple fact is the Democrats didn't like it because they want fodder for the fall elections.

The real reason why college is expensive is the far left professors teaching at colleges. College costs are based in large by the large salaries these teachers get.

..

Government! Colleges & universities know they can raise the price of tuition because the student can easily get a loan from the government!

..

I can see where all of the mentioned items created the problem, and each has to be addressed in order to solve it. Financial literacy isn't taught at all - few can balance a checking account these days - and rational thought where the pros and cons of taking out a loan or going to a less expensive college or trade school isn't even on the agenda.

..

whos to blame?? let me think, maybe its the greedy professors that make an obscene amount of money for very little work. How about the entitlement mentality of the students? Could it be the Govt. involved where it doesn't belong? Could it be the foreign students that never repay their loans? How about a top heavy administration? Illegal alien students enrolled in colleges? We are all to blame in one way or another. But maybe the worst cause is the politicians making promises to buy votes.

Laissez les bon temps rouler!  Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

-

-

This Bright-Eyed Young Man Was Utterly Demolished by Student Loans

By Mandi Woodruff | Business Insider – Wed, May 30, 2012 3:56 PM EDT.

Even as total outstanding student debt rises to $1 trillion, lawmakers have yet to allow loans to be discharged in bankruptcy. Without an escape clause, these loans can strangle a person. Take 36-year-old Nick Keith, who remains $142,000 in debt eight years after graduating from culinary school. He's featured in a new film, "Default: The Student Loan Documentary," in which several college graduates expose the pitfalls of the private student loan industry. "I want to educate the public about the facts," Keith said. "My life has become a daily swim in a tar pit with very little hope of ever getting out."

Keith's father only agreed to co-sign a student loan if he stuck with an engineering degree at Iowa State University, but even with decent grades, he knew it wasn't a right fit. He dropped out sophomore year and later turned to the California Culinary Academy–without his dad as a safety net–hoping to put his love for healthy eating to use. "The culinary academy commercials were on the Food Network every 15 minutes," he said, and only required 12 months of study with a three month externship.

He fell for their sales pitch, hook line and sinker "I should have seen all the signs. [The campus tour guide] had a used car salesman answer for everything," Keith recalls.

The magic number was always 99 percent–whether Keith asked how many enrolled students graduated or how many graduates scored jobs afterward.

Feeling confident, Keith took out $46,000 in private loans He then took out another $14,000 in federal loans to cover his rent, since the school's fees didn't include room and board. But "I was lied to about the terms of the private student loan," Keith says. "And after completing the program, my first job in the culinary field (working on a meal assembly line) paid $10 per hour."

He wasn't the first one to be duped

In September, the California Culinary Academy agreed to pay $40 million back to thousands of students in a class action suit claiming they were misled about the program. The school allegedly boasted a "48 percent to 100 percent" success rate for graduates looking for work, but students claimed the calculation included jobs that didn't require a culinary education at all.

With just a part-time job, it took three months to make the first loan payment of $1,300. He was also paying a 19% variable interest rate – nearly triple the capped interest rate on federal unsubsidized loans. "I spoke to (private loan issuer) Sallie Mae. I wrote to Sallie Mae. But Sallie Mae would not refinance my debt with a reasonable interest rate or reasonable payments," he says. "I could not afford to make a student loan payment because my choice each month was to either pay my rent or make a student loan payment."

Sallie Mae's best offer? A $50 to $100 reduction in his monthly payments.

Bankruptcy wasn't an option

No matter how deep borrowers find themselves buried in student loan debt, federal law prevents them from discharging it in bankruptcy court–unless they can prove "undue hardship." "Most bankruptcy attorneys do not pursue a discharge of student loans because the undue hardship restriction is such a harsh standard," according to Mark Kantrowitz, publisher of FinAid.org.

With no hope of meeting his monthly payments, Keith threw his hands up and basically let the debt collectors have at him. "They call every day, a couple times a day," he says. "I send their numbers straight to voicemail." Eventually he stopped making loan payments altogether Keith sought advice from a bankruptcy attorney as well as a couple of CPAs on how to handle his loans. Both gave him the same advice: Stop paying.

They reasoned that with so many students in Keith's position, Congress would eventually revamp its personal bankruptcy laws to allow loans to be forgiven.

Nearly a decade since he took out the original loan, his balance has ballooned to $142,000 with a 17% interest rate–and the law hasn't budged.

And the blows just kept coming

"Just as I was getting close to getting my financial house in order, I was injured at work and became permanently disabled," Keith says.

Six years later, Keith's only source of income is a $1,200 monthly disability check, going so far as to collect cans and bottles for extra pocket money. "I get groceries at the local food bank," he said. "I have sold or lost 99 percent of everything I ever owned."

The outlook remains pretty grim

Keith's expecting about $16,000 from the $40 million CCA settlement in July, but that's only if the school doesn't file another appeal.

In the meantime, his credit score has fallen below 550, he's had trouble securing even auto insurance, and finding work is a struggle–not to mention the fact that none of his CCA credits will transfer if he decides to go back to school. "Any employer that checks my credit history will surely have to raise questions as to why my credit shows only defaulted or charged-off accounts," he says. "All of my good credit that showed I paid everything in full and on time is now past seven years old and has fallen off my credit report."

For the time being, he's living out of his van

Keith camped out in his dad's heated garage for the better part of 2011, hoping he'd be able to either find a job or sell enough of his belongings to afford to move back West for work. When we caught up with him in late May, Keith said things with his father turned sour and he used the $2,500 or so he raised on hotel stays instead. As of last week, with the rest of his savings dried up, Keith officially joined the ranks of the homeless.

He's living out of an aged minivan, taking advantage of Salvation Army for meals and groceries. At night, he crashes at highway truck stops, where he says he's rarely bothered. "All that I, and the rest of the folks in this mess, are asking for is that Congress simply return the "Truth in Lending" policies and procedures to all student loans (both federal and private)," he said. "As well as return the ability to discharge student loan debt through bankruptcy."

http://finance.yahoo.com/news/this-b...ent-loans.html

comments

"Dad, about that offer for the engineering degree..."

Bet that offer isn't looking half bad now huh? Eh, ya live and learn.

...

Poor financial management. Many students do not know how to prioritize, budget and plan ahead. They only see the short-term gain without taking into account the long-term consequences. I worked two jobs to pay for a bachelors and masters. I now have a PhD and pay very low interest. In less than three years it will be paid off. Be responsible

...

How about take responsibility for the choices you make and not ask the gov't to bail you out with bankruptcy?

...

What do Thomas Keller, Joel Robuchon, and Gordon Ramsey all have in common?

1) They are all world reknowned chefs holding multiple Michellin stars a piece.

2) They all have no cullinary degree to their names. They started out in kitchens as potato peelers and dishwashers.

Ramsay was also a soccer player until he got injured. Funny that. I wonder if he'd still be a successful restaurateur if he could play soccer?

...

I agree with you Just the facts, unfortunately, these are the success stories you hear about because these chefs are so famous. What happened to the other millions of dishwashers and potato peelers out there that can actually cook and were never given the chance.

...

Gordon Ramsey didn't have to compete with illegal labor for his dish washing and potato peeling!

...

Just remember when " It's to good to be true " Run, Run, Run, Why didn't you run when they talked to you like a used car salesman ?????

The alarm bells were silenced when it came too him.

...

Should have finished that engineering degree. I was actually close to pursuing a graphic design degree from a similar type of school, but decided to stick with Econ. Now I am glad I stuck with Econ.

..

High schools should warn their students about these colleges making claims that aren't true.The colleges should be required to put the REAL statistics on the forms to be signed.

Kids should pay attention in school and maybe they wouldn't have to chase these third rate diplomas.

...

This isn't college. College has two years of general education background and then two years as you major and specialize. It gives you some kind of grounding for the world ahead and allows you access to the better paying jobs.

...

As someone who graduated high school not too long ago, I can say that the teachers don't help. They encourage students to go to those for-profit schools and "chase their dreams". And they teach that "don't let money be an excuse for not going to school". Now that's all fine and good if you know how to manage money and not take out ridiculous loans, but most teenagers haven't a clue.

..

Despite having the grades to get into a private university, I decided to instead spend two years at a cheaper community, THEN transfer in, so I wouldn't have to sell my soul to pay for college. Best decision I ever made.

...

I did the same thing. The community college was less than half the price of the local state school and I got the first two years done there and lived at home. I don't know why everyone doesn't do this. Then you can decide what you want to major in and if college is even for you without signing your life away.

...

Always a good idea to read the terms of a loan, and maybe research a job market for the profession before spending your money and time.

Laissez les bon temps rouler!  Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

-

-

Another problem is when schools steer students to certain banks for loans and force certain debit cards with high fees and interest rates. It is all a game and the only ones getting rich are the banks, schools and elected officials who create a way for them to get more $$$$.

Plus in Illinois 9% interest is the cap on private party loans. Anything above that is usury. Except for banks, credit card companies, payday loans etc. It should be capped for all.

Me

-

-

‘Student loans have basically ruined my life’: Yahoo News readers tell their stories

By Phoebe Connelly, Yahoo! News | The Lookout – 4 hrs ago

(Don Ryan/AP)Ah, the summer after graduation. With rented caps and gowns returned, most graduates are hitting the pavement to look for work, or trying to ace that final internship in the hopes that they'll be hired on. But even for those who find employment, there likely remains nagging bit of unfinished business: student loans.

According to figures from the Federal Reserve Bank of New York, 37 million Americans hold student loan debt. The total amount of student loan debt in the United States is estimated to be between $867 billion and $1 trillion dollars, and default rates for student loans continue to rise. In 2012, the majority of unemployed Americans had at least some college education—the first time in our nation's history this has occurred. On Tuesday, Republican and Democratic leaders in the Senate announced they had reached an agreement on a bill to continue subsidizing student loans, keeping interest rates at 3.4 percent rather than letting them rise to 6.8 percent.

We asked Yahoo News readers to tell us their experiences with student loan debt. Over 600 graduates (and not-quite graduates) of all ages emailed to share their stories. We'll be sharing more of their stories in the next week over at our Tumblr.

Overwhelmingly, Yahoo News readers told us they felt burdened by their debt. "We do not like debt," wrote Katelyn Fagan, who graduated from Brigham Young University in 2011. She and her husband have a combined student loan debt of just under $70,000. Fagan tried to work while in college, but wanted to focus on her academics. "Maybe I could have sought out other employment options (and I sometimes did) but school was my top priority."

"Student loans have basically ruined my life," says Tanya Carter, who graduated from the University of Toledo in 2008. She went to community college for two years before transferring, and attended classes part-time so she could also work. When Carter maxed out on federal loans, she turned to private loans to finish her degree. As a result of all that debt, she writes: "I never see myself owning a home, vehicle, or maybe not even getting married."

The need to delay starting a family because of financial worries was a common concern. Lauren Dollard graduated from Fordham University in 2008 with $157,000 in debt, including interest. "My boyfriend won't marry me because of my debt," she says. "He doesn't want it attached to his name (I know, this could also be an excuse)." She said she would trade her "fancy private school education" in a heartbeat to live "as an independent adult."

April Flores graduated from San Diego State in 2008 with $80,000 in private loans and $30,000 in subsidized loans. "It is going to be hard to buy a house and start a family with our debt," she writes. "We joke and say that our baby is Sallie Mae, but it is true! Education is invaluable, but I was not wise in my early 20s and did not make the right decisions when it came to my private loans."

Flores was far from alone in bemoaning her failure to understand the implications of those promissory notes. Salvatore Aiello graduated from the University of South Carolina in 2009 with $68,000 in debt. "I blame ignorance in my pursuit of loans; my high school did a terrible job explaining our options when it came to financial aid," he told us. "They made it seem that if I wasn't rich or beyond poverty I would not have been able to go to college." Aiello followed up with a second email—he and his girlfriend are now expecting their first child. They are, in his words, "very excited at the unexpected blessing but terrified."

Logan Canale attended Queens University in Charlotte, N.C.—and started feeling the pain of loans before her graduation in 2009. One borrower came after her for nonpayment of loans while she was still enrolled and taking classes. "My private college was way too expensive for what it was worth," Canale writes. "I just feel like I have been beaten by the system and taken advantage of. Who is making money off my education? Because it is not me."

Amber Riffey graduated from Saint Mary-of-the-Woods College in 2005, and says she was simply too naive: "I wish that schools and student loan officers [would] sit down and actually explain how Sallie Mae works [...] I was just told how much I owe SMWC and 'sign here on the dotted line so we can get you signed up for next semester's classes.'"

"If I had the knowledge then that I do now, I would have paid as I went (yes, it would have most definitely taken longer but at least I would have graduated with my diploma and debt free)," says Riffey.

Although Bobbi Carlin left school before receiving a degree, she attended the University of Nebraska-Lincoln and Southeast Community College. "Honestly, I let my parents [handle loans] for me, and when I left school, before graduating, I had no idea that I had more than one loan," says Carlin. "I paid that loan off, and discovered later there was another." She's worked to pay off all of her loans, and now has a little less than $600 in outstanding loan debt.

While students are often told that if one school isn't a good fit for them, they should transfer to another, that can add years to their education—which usually means added debt as well. Eric DeRise went to multiple universities before graduating from University of Connecticut in 2008. DeRise says he understood the details of his mounting student loan debt, but he had no grasp of what it would actually mean for his post-graduation life. "Believe me, I understood that I'd have to pay back the loans 6 months after I graduated, and I understood the strict consequences of not paying them back," he writes. "But do you think of any of that when you're 18-20 years old?" DeRise is making less than $40,000 a year at a nonprofit in Salt Point, N.Y., and he worries about how he will cover his monthly payment if interest rates rise.

But not everybody had sympathy for graduates who complain about their debt load. Robbin S. is an older graduate—she finished her degree in business from the University of Phoenix in 2003, when she was 46. She still owes $17,500 in loans. "I'm really sick of the whiny babies complaining about their $100,000 of student loan debt and how they will never be able to pay it off," she writes. "Who in their right mind thinks that $100,000 of student loan debt (with a BS in a worthless field) is reasonable?"

For other graduates, who pursued a degree when they found themselves unable to compete in a changing workforce, the accumulated loans could be salt in the wound.

Kim Shannon of Eaton Rapids, Mich., received an associates degree in human resources management in 2010. Several years later, she is still looking for work, and the loans she placed in deferment and forbearance are entering repayment. "I am no longer optimistic about the future. After so many rejections, I have all but given up my job search," says Shannon. "If I could go back and change things, I would. I would have gone someplace where I could learn a more marketable skill, like driving a forklift. I thought I would be happy to finally get a degree, but I'm not."

And then there are those parents who find themselves responsible for paying off loans they co-signed with their children. Karen DeSimone of Rancho Cucamonga, Calif., is on the hook for $17,000 in loans she co-signed for her son. "We did everything we could do to get my son started," she writes. "Now we both have the loan debt."

We'll end on an optimistic note: Some Yahoo News readers felt positive about their debt, despite the challenges it posed.

Frank Mendoza of Miami, Fla., graduated from Florida International University in 2010. "I still feel that getting my degree was an achievement worthy of pride. I am, after all, the first male in my family to have a college education," writes Mendoza. "It comforts me to know that I am not the only one in this type of rough financial situation and that even this shall pass."

http://news.yahoo.com/blogs/lookout/...105332697.html

Laissez les bon temps rouler!  Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

-

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Reply With Quote

Reply With Quote