-

04-06-2016, 07:52 PM

#1024

Our premiums are over $9 THOUSAND a year for a family of five... with over 9 THOUSAND in deductibles.

Thanks.

Laissez les bon temps rouler!  Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

-

-

04-06-2016 07:52 PM

# ADS

Circuit advertisement

-

04-19-2016, 08:52 PM

#1025

Deserting ObamaCare: UnitedHealth, nation's largest health insurer, bolts, fears huge losses

Published April 19, 2016

The nation’s largest health insurer, fearing massive financial losses, announced Tuesday that it plans to pull back from ObamaCare in a big way and cut its participation in the program’s insurance exchanges to just a handful of states next year – in the latest sign of instability in the marketplace under the law.

UnitedHealth CEO Stephen Hemsley said the company expects losses from its exchange business to total more than $1 billion for this year and last.

Despite the company expanding to nearly three dozen state exchanges for this year, Hemsley said the company cannot continue to broadly serve the market created by the Affordable Care Act's coverage expansion due partly to the higher risk that comes with its customers.

UnitedHealth Group Inc. said it now expects to lose $650 million this year on its exchange business, up from its previous projection for $525 million. The insurer lost $475 million in 2015, a spokesman said.

UnitedHealth has already decided to pull out of Arkansas, Georgia and Michigan in 2017, and Hemsley told analysts during a Tuesday morning conference call that his company does not want to take the financial risk from the exchanges into 2017.

"We continue to remain an advocate for more stable and sustainable approaches to serving this market," he said.

The state-based exchanges are a key element behind the Affordable Care Act's push to expand insurance coverage. But insurers have struggled with higher-than-expected claims from that business.

A recent study by the Blue Cross Blue Shield Association detailed how many new customers nationwide under ObamaCare are higher-risk. It found new enrollees in individual health plans in 2014 and 2015 had higher rates of hypertension, diabetes, depression, coronary artery disease, HIV and Hepatitis C than those enrolled before ObamaCare.

Doug McKelway reports from Washington, D.C.

On the heels of Tuesday's announcement, Sen. Ben Sasse, R-Neb., said in a statement it’s a sign of “the President’s broken promise that families would have more choices under ObamaCare.”

The Kaiser Family Foundation, in an analysis on the prospect of United's exit, said “the effect on insurer competition could be significant in some markets – particularly in rural areas and southern states” if it is not replaced. http://www.foxnews.com/politics/2016...ntcmp=trending

In the most extreme scenario, “If United were to leave the exchange market overall, 1.8 million Marketplace enrollees would be left with two insurers, and another 1.1 million would be left with one insurer as a result of the withdrawal,” the analysis said.

UnitedHealth had moved slowly into the newly created market by participating in only four exchanges in their first year, 2014. But the company then expanded to two dozen exchanges last year and said in October it would add to that total. It currently participates in exchanges in 34 states and covers 795,000 people

A month after announcing its latest exchange expansion, UnitedHealth started voicing second thoughts. The insurer said in November that it would decide by the first half of this year whether to even participate in the market for 2017.

Insurers say they have struggled, in particular, with customers who have signed up for coverage outside regular enrollment windows and then dumped expensive claims on their books, a problem the government has said it would address.

A dozen nonprofit health insurance cooperatives created by the ACA to sell coverage on the exchanges have already folded, and the survivors all lost millions last year.

Other publicly traded insurers like Aetna have said that they have lost money on this business as well. But some companies, like Molina Healthcare, have said they have managed to turn a profit from the exchanges.

Analysts expect other insurers to also trim their exchange participation in 2017, especially if they continue to struggle with high costs.

http://www.foxnews.com/politics/2016...ntcmp=trending

Laissez les bon temps rouler!  Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

-

-

04-20-2016, 02:08 PM

#1026

Originally Posted by

Jolie Rouge

Our premiums are over $9 THOUSAND a year for a family of five... with over 9 THOUSAND in deductibles.

Thanks.

I'm single..........no kids.

I recently changed jobs and had to go the usual 60-90 days without insurance. I checked "Obama's" website, to see what I could get just for those 2-3 months.

HA!!! What a joke. Cheapest thing for me was $450 a month, with a $6000 deductible!!!!! FOR JUST ME!!! :O

WTH is the point!!!?? If I had 6 grand, I wouldn't need the damn insurance!!!

The insurance I have with my employer isn't much better.............$100 a month, with a $3000 deductible! lol

Last edited by 3lilpigs; 06-17-2016 at 07:36 PM.

-

-

06-17-2016, 07:36 PM

#1027

My insurance just went UP!!!

I'm now paying $174 a month!! (still with the $3K deductible!).

And to make matters worse, my employer took out $50 MORE than they should have!!

ABSOLUTE WASTE OF MY MONEY!!!

-

-

06-23-2016, 07:51 PM

#1028

Hundreds arrested for $900 million worth of health care fraud

By Joshua Berlinger, CNN - Updated 10:05 AM ET, Thu June 23, 2016

The Justice Department announced Wednesday it's charging hundreds of individuals across the country with committing Medicare fraud worth hundreds of millions of dollars.

It's the largest takedown in history -- both in terms of the number of people charged and the loss amount, according to the Justice Department. The majority of the cases being prosecuted involve separate fraudulent billings to Medicare, Medicaid or both for treatments that were never provided.

In one case, a Detroit clinic that was actually a front for a narcotics diversion scheme billed Medicare for more than $36 million, the Justice Department said.

The takedown: By the numbers

$900 million in false billing

$38 million sent from Medicare and Medicaid to one clinic to carry out medically unnecessary treatments

$36 million billed to Medicare by a Detroit clinic that was actually a front for a narcotics diversion scheme

1,000 law enforcement personnel involved

301 defendants charged across the United States

61 of those charged are medical professionals

36 federal judicial districts involved

28 of those charged are doctors

A doctor in Texas has been charged with participating in schemes to bill Medicare for "medically unnecessary home health services that were often not provided."

And in Florida, the owner of several infusion clinics is accused by the federal government of defrauding medicare out of over $8 million for a scheme involving the reimbursement for expensive intravenous drugs that were never actually purchased and never given to patients.

"Health care fraud is not an abstract violation or benign offense. It is a serious crime," Attorney General Loretta Lynch said. "They target real people -- many of them in need of significant medical care. They promise effective cures and therapies, but they provide none. Above all, they abuse basic bonds of trust -- between doctor and patient; between pharmacist and doctor; between taxpayer and government -- and pervert them to their own ends."

http://www.cnn.com/2016/06/23/health...own/index.html

Laissez les bon temps rouler!  Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

-

The Following User Says Thank You to Jolie Rouge For This Useful Post:

-

06-23-2016, 09:39 PM

#1029

my question is: when they recover the money, who will get the money? I ask because government is always suing someone or some company but the money does not seem to make it's way to the people who put the money out there. if the government recovers money, will it go back to medicare/medicaid or will if go to places like obamacare?

Last edited by boopster; 06-23-2016 at 09:58 PM.

-

-

06-24-2016, 06:55 AM

#1030

Originally Posted by

boopster

my question is: when they recover the money, who will get the money? I ask because government is always suing someone or some company but the money does not seem to make it's way to the people who put the money out there. if the government recovers money, will it go back to medicare/medicaid or will if go to places like obamacare?

Good question

Laissez les bon temps rouler!  Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

-

-

07-28-2016, 08:08 AM

#1031

16 Obamacare Co-Ops Collapsed. Here’s How the Rest Are Faring.

Melissa Quinn July 26, 2016

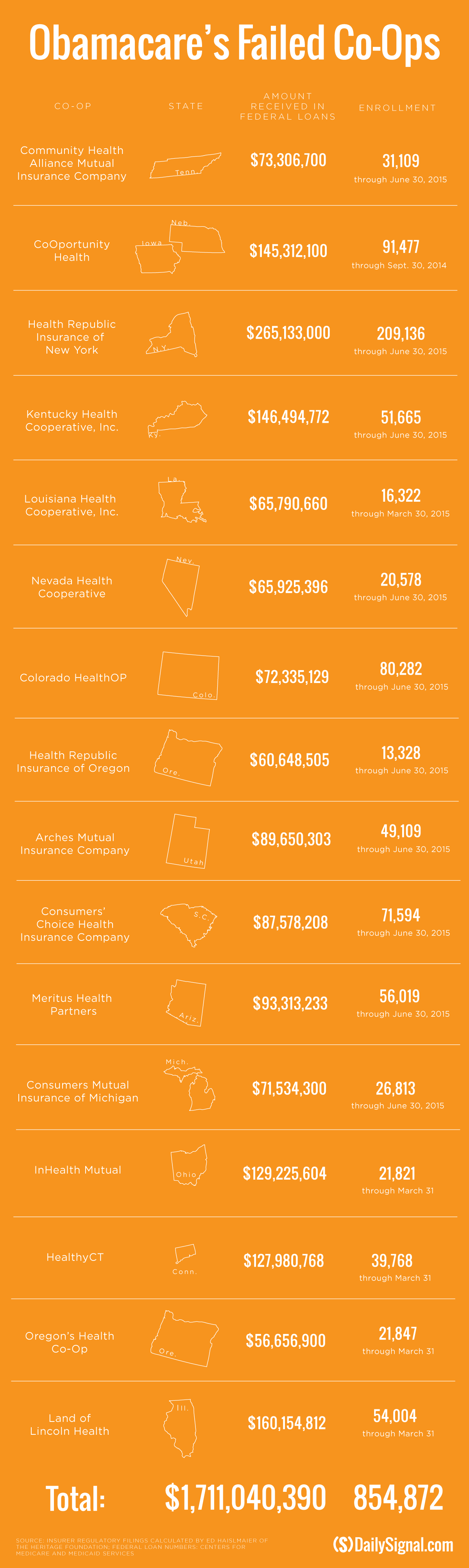

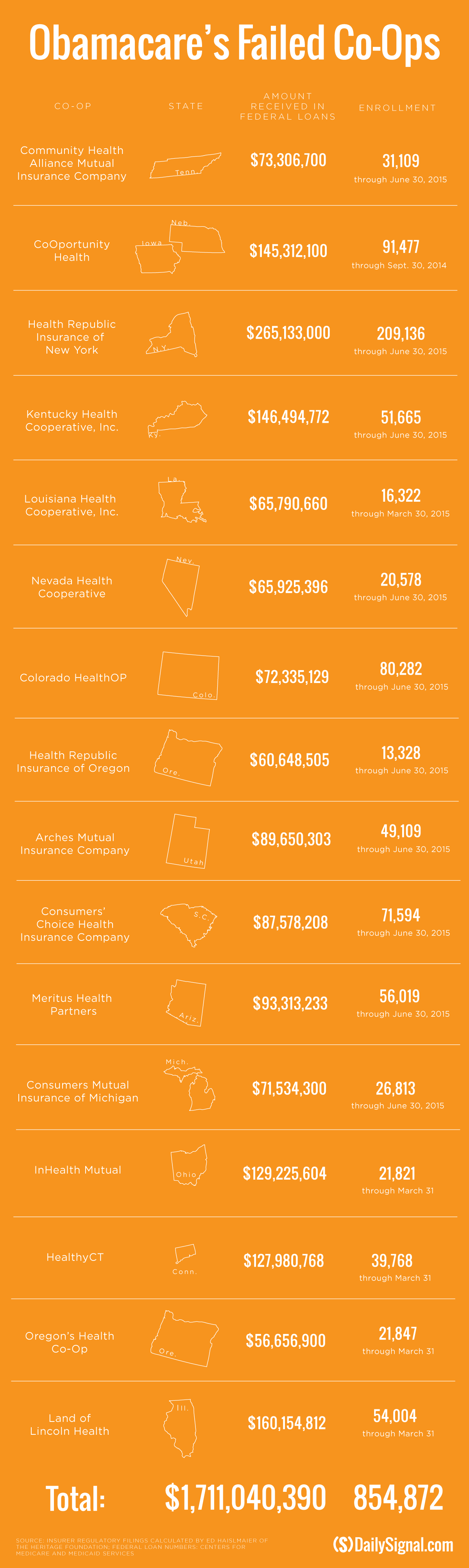

Since Obamacare’s rollout in the fall of 2013, 16 co-ops that launched with money from the federal government have collapsed.

The co-ops, or consumer operated and oriented plans, were started under the Affordable Care Act as a way to boost competition among insurers and expand the number of health insurance companies available to consumers living in rural areas.

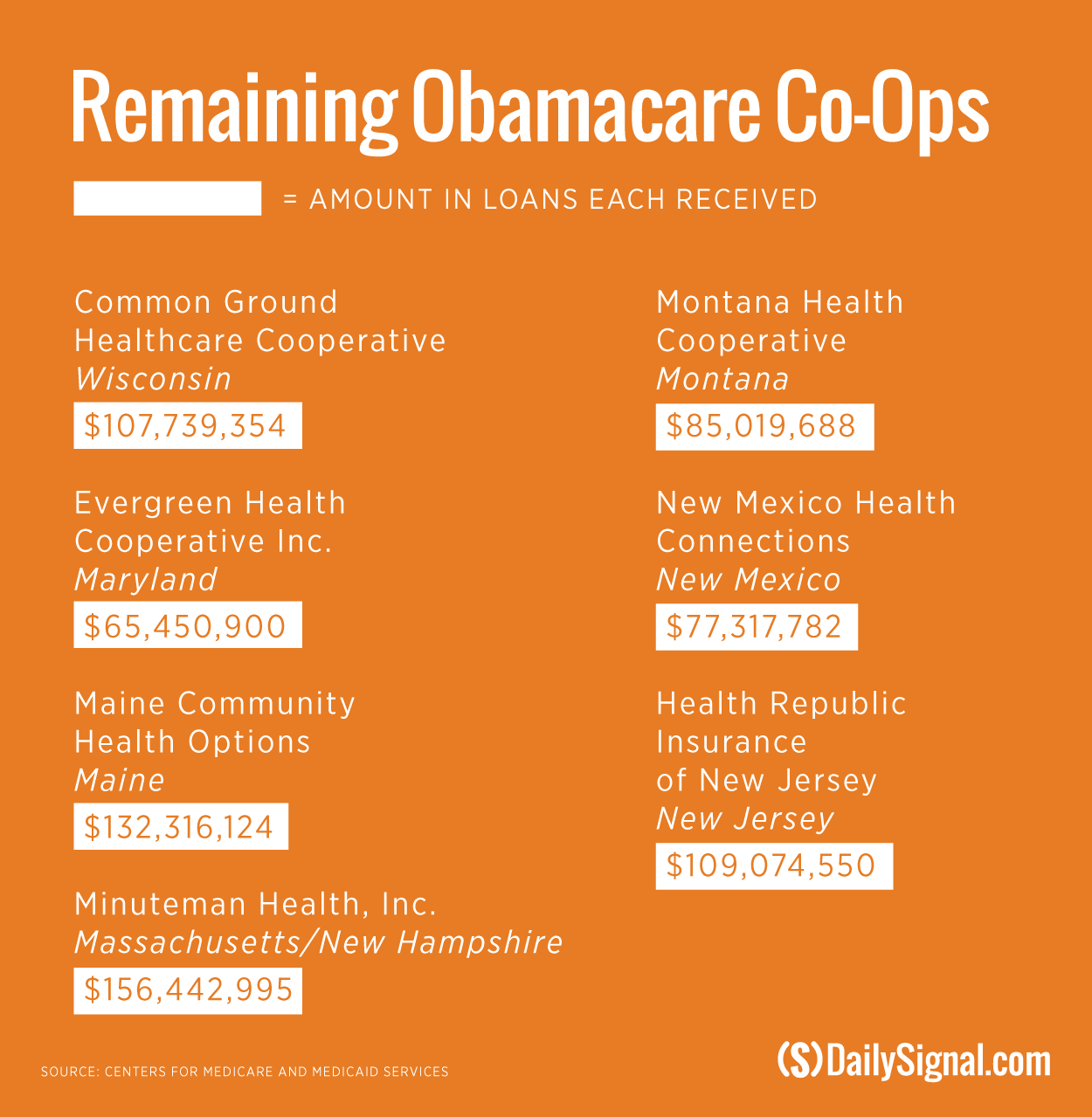

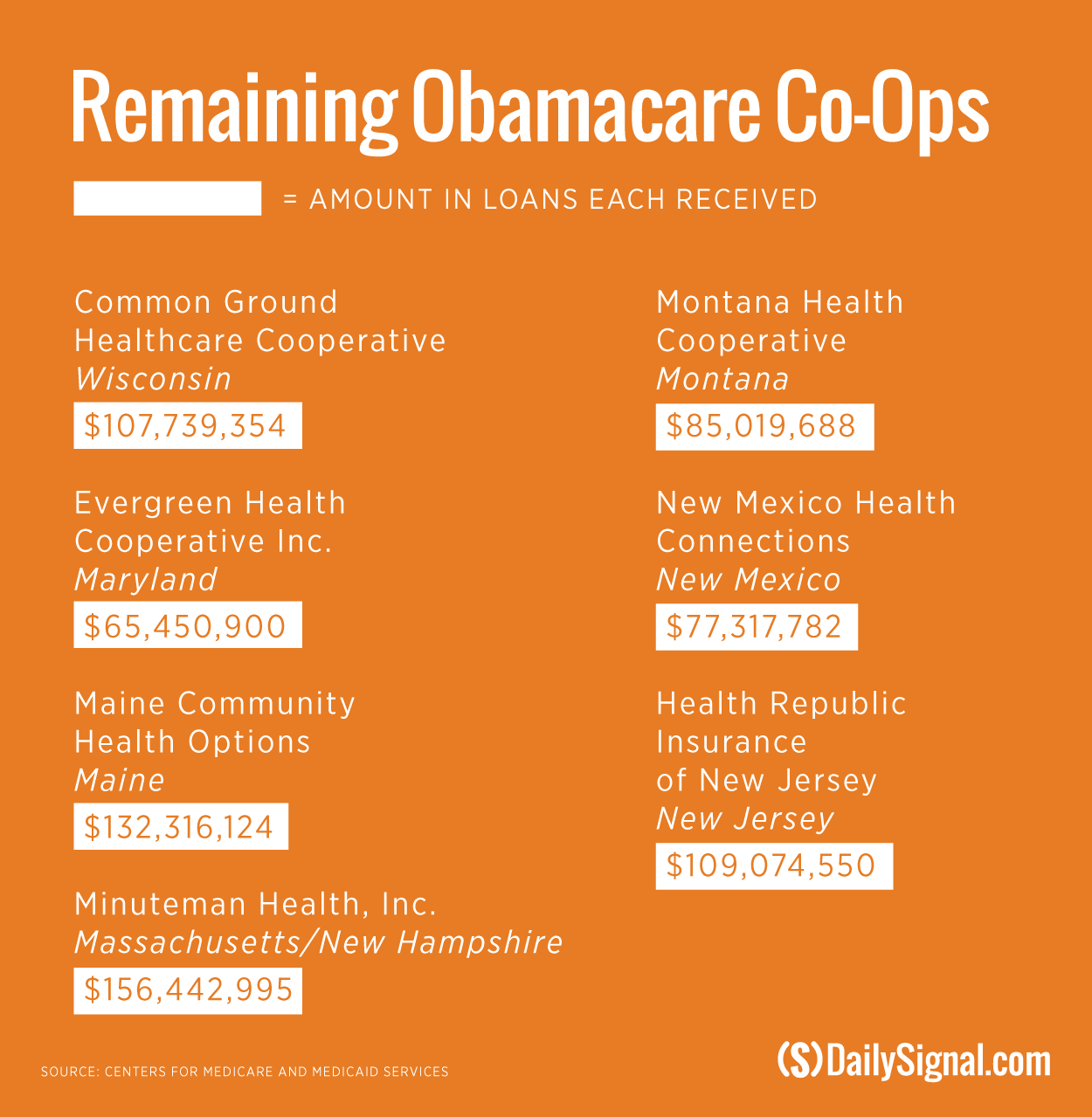

Now, just seven co-ops—Wisconsin’s Common Ground Healthcare Cooperative; Maryland’s Evergreen Health Cooperative; Maine Community Health Options; Massachusetts’ Minuteman Health; Montana Health Cooperative; New Mexico Health Connections; and Health Republic Insurance of New Jersey—remain.

Despite the grim financial footing from previous years, health care experts agree that it’s likely some—though not all—co-ops may remain standing for at least a few more years.

“I definitely think there are some co-ops that have seemed to have relative success in the market,” Caroline Pearson, a senior vice president at Avalere Health, told The Daily Signal. “I think we will have some surviving co-ops a couple years from now, but I can’t promise we won’t have a handful more that may fail over time.”

But for the seven co-ops left to survive, Pearson warned they will have to increase the cost of their premiums, especially since many of the nonprofit insurers kept the costs down during the beginning years of Obamacare’s implementation to attract customers.

“The big issue for the co-ops is getting the pricing right,” she said. “They really need to make sure they’re accurately assessing the medical risk of the exchange enrollees and pricing in such a way they can cover those costs.”

“I think there was very aggressive pricing strategies by many carriers in the first few years of the exchanges to try to win enrollment, and that’s really resulted in big losses for most of them,” Pearson continued.

Struggling to Make Money

The Centers for Medicare and Medicaid Services awarded $2.4 billion to 23 co-ops that were eventually created. However, the majority of the co-ops struggled to turn a profit, resulting in the collapse of 16 of the original 23 that received $1.5 billion in startup and solvency loans.

Now, with just seven co-ops remaining, regulatory filings show that many ended 2015 in the red.

Maine Community Health Options ended up losing money in 2015 after having a successful 2014.

The Maine co-op was the only one to make money in 2014 and hit its enrollment targets. But by the end of 2015, Maine Community Health Options’ finances took a turn for the worse and the co-op lost $74 million.

Already, regulatory filings for the first three months of 2016 show Maine Community Health Options posting more than $8 million in losses.

Officials with Maine Community Health Options did not return The Daily Signal’s request for comment.

Pearson said the Maine co-ops’ early success can be attributed to the state’s insurance market.

“The advantage of Maine is it is a relatively noncompetitive, or less competitive market,” she said. “It makes it easier for co-ops to enter the market and win market share because there aren’t so many entrenched companies.”

Wisconsin’s co-op, Common Ground Healthcare Cooperative, initially exceeded its enrollment projections in both 2014 and 2015.

However, the co-op ended up losing $43.2 million last year, according to the Milwaukee Journal Sentinel.

For the first three months of 2016, Common Ground Healthcare Cooperative reported losses of $4.7 million, according to regulatory filings.

Thomas Miller, a resident fellow at the American Enterprise Institute who is an expert in health policy, said each of the seven remaining co-ops have “warning indicators” leading up to when, and if, they fail.

“As a general rule, this has already been the case with the ones that have failed to a large extent, usually the ones that grew the fastest and were the biggest were the ones that had the most problems,” he told The Daily Signal.

Miller specifically referenced the Health Republic of New Jersey, which made money in the first nine months of 2015, as an example of a co-op that grew quickly but shows warning signs of collapsing.

The co-op said it lost $17.6 million at the end of 2015 and is facing a $46.3 million payment to the government through the risk adjustment program, which was designed to spread risk among insurers.

To the contrary, Miller pointed to Maryland’s Evergreen Health and New Mexico Health Connections as two co-ops that could live on for a few more years.

“If you’re small, you can sometimes survive because the magnitude of your losses aren’t to the extent that the state insurance commissioner feels like, ‘Oh my gosh, this is really going to be bad for us and we really have to pull out before the open enrollment season,’” he said.

Still, Miller said it would be difficult for the co-ops that have been hemorrhaging money consistently over the years to recover.

“When they’re bleeding, they keep bleeding, and they continue bleeding, and at some point you have to cart them away,” he said.

Laissez les bon temps rouler!  Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

-

-

07-28-2016, 08:10 AM

#1032

16 Obamacare Co-Ops Collapsed. Here’s How the Rest Are Faring.

Melissa Quinn July 26, 2016

CONTINUED

Weathering the Years

Since Obamacare’s implementation, it’s not only co-ops that have struggled to make money.

Oscar, a startup insurance company serving New York and New Jersey that launched in 2012, lost $105 million in 2015.

Additionally, UnitedHealth Group CEO Stephen Hemsley said the company expects to lose more than $1 billion from its exchange business—$650 million in 2016 and $475 million in 2015.

The company, which is the nation’s largest insurer, decided to pull out of at least 26 of the 34 exchanges it offered coverage on last year after warning the marketplaces were a risky investment.

And Health Care Service Corporation, which operates Blue Cross Blue Shield plans in five states, reported losses totaling $65.9 million in 2015. The company lost $281.9 million in 2014.

Despite across-the-board losses for insurers of all sizes, both startups and established insurance companies have been able to remain afloat while the majority of the co-ops collapsed

“The benefit that these co-ops didn’t have, in addition to just fiscal reserves, was a diversity of markets they’re participating in,” Pearson said. “Lots of exchange plans have financial difficulty, but they could rely on their broad book of business to weather the initial years of challenge. Co-ops haven’t had that chance.”

In addition to increasing the cost of their premiums to compensate for their beginning years of enrollment, Pearson said the co-ops may also need to bump prices up to prepare for the end of the risk corridor and reinsurance programs, which were put in place until the end of this year.

The risk corridor and reinsurance programs are two of the “three R’s”—risk adjustment being the third—designed to spread risk among insurance companies enrolling consumers through the exchanges.

The co-ops received less money than they initially anticipated last year under Obamacare’s risk corridor program, which resulted in the collapse of at least five co-ops and a $5 billion class action lawsuit filed by Health Republic Insurance of Oregon, one of the state’s co-ops.

The reinsurance program, meanwhile, has helped the co-ops, albeit marginally. According to data released by the Department of Health and Human Services last month, the seven remaining co-ops could collectively receive $132.3 million in payments from the reinsurance program.

But with the end of the reinsurance program coming at the end of the year, the additional infusion of cash to the co-ops will go with it.

“The risk corridor, everybody has sort of already written off,” Pearson said, “but the lack of reinsurance is a challenge, especially for small plans and again sort of underscores the need for a big rate bump.”

Still, Miller said even if the co-ops raise their premiums, it’s unlikely the remaining seven will be able to turn their businesses around.

“When you’ve got a terminal illness, it is going to catch up eventually. Whether some can go into remission or basically string it along for a stretch of time, we always get these periodic predictions that, ‘Oh, if we just have next year it’ll be different,’” he said. “There’s just not something on the horizon. There’s just not some other approach that seems viable as to how they get out of the box they’re already in.”

http://dailysignal.com/2016/07/26/16...st-are-faring/

comments

Obamacare is fatally flawed and will collapse, under it's own weight. In truth, there is nothing in Obamacare that improves and manages costs in the health care delivery system. It is nothing more than a reshuffling of who pays for it. The vast majority of new insureds are Medicare recipients, who pay absolutely nothing. The real proof about Obamacare is that the federal government employees don't even want it.

We need to eliminate Obamacare and find a whole new approach to this serious issue.

...

The ultimate plan with Obamacare was for universal healthcare for all provided by the bankrupt US, which continues to let illegals pour in and cause more massive outpouring of borrowed money. Only the rich will have the best medical care. Everyone else will have to fend for themselves with whatever bankrupt America will try to provide.

,,,

“The big issue for the co-ops is getting the pricing right,” she said. “They really need to make sure they’re accurately assessing the medical risk of the exchange enrollees and pricing in such a way they can cover those costs.”

Well, duh. When you're in the INSURANCE business, you have to assess the RISKS (you are insuring) and then PRICE your products to provide you a profit. Kinda obvious, eh?

..

The cost per person varies from 901 (Colo) to 5922 (Ohio) with the average per person at 2676. This half of what my formerly good policy cost me per year. The study only covered tax funded money to the exhanges and did not include tax refunds or credits some of the clients probably received. And these were the exchanges that failed! I wonder what these figures are for the exchanges that are still operating in the black, if any

...

While Comservatives can say this was a very expensive "I told you so", we have to realize that Democrats are never going to accept facts that don't support furthering their programs. At best, they will say they knew the scheme wouldn't work, but that it was a compromise that 'supposedly' utilized the free market and that ruthless corporations caused the whole thing to fail and the wealthy just need to pay their fair share of taxes so we all can enjoy free government run healthcare.

Last edited by Jolie Rouge; 07-28-2016 at 08:12 AM.

Laissez les bon temps rouler!  Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

-

-

08-02-2016, 07:16 AM

#1033

Chelsea Slips Up, Just Said Something That Will End Hillary’s Campaign [VIDEO]

Ryan Hodge

August 1, 2016

When Chelsea Clinton thought the cameras were off, she revealed that her mother Hillary believes the Affordable Care Act should be expanded to include “undocumented” immigrants.

While speaking to a “gay, Latino” supporter, Chelsea confirmed that her mom is a huge supporter of Obamacare “for all.”

“My mom has very strong feelings that we must push as quickly as possible for her comprehensive immigration reform, and this is a real difference between hers and Senator Sanders’ record,” Chelsea claimed.

“She supported comprehensive immigration reform at every possible chance and she was one of the original supporters and sponsors of the DREAM Act.”

“She does not believe that while we are working towards comprehensive immigration reform we should make people wait, like the families you are talking about,” Chelsea continued.

“Which is why she thinks it’s so important to extend the Affordable Care Act to people who are living and working here, regardless of immigration status, regardless of citizenship status.”

What do you think of Chelsea’s claims?

I think Chelsea - like any "good" politician - is simply saying what she thinks the reporter wants to hear, whatever will garner a few more votes. They can't pay for what they are already attempting to do, and it isn't as if the Clintons actually care about the unnamed, unwashed masses beyond doing what ever it takes to get those votes. JMHO

Laissez les bon temps rouler!  Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

-

-

08-02-2016, 09:52 PM

#1034

so chelsea says hillary is against the constitution and is for breaking the laws of the united states of america - which is in line with obama and his cohorts. if as this man says the undocumented (best described by the word illegal) have money to pay for health insurance then i would like to see how much they make, how much they pay in taxes and ask what do they already collect from the us taxpayers. have they ever used a hospital er and if so did they pay anything for the services rendered? if they want to become US citizens, why have they not filled out the forms to legally immigrate? Are ready to pledge their allegiance to the USA and assimilate with USA culture?

-

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Laissez les bon temps rouler!

Laissez les bon temps rouler! Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!

Going to church doesn't make you a Christian any more than standing in a garage makes you a car.** a 4 day work week & sex slaves ~ I say Tyt for PRESIDENT!  Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Not to be taken internally, literally or seriously ....Suki ebaynni IS THAT BETTER ?

Reply With Quote

Reply With Quote